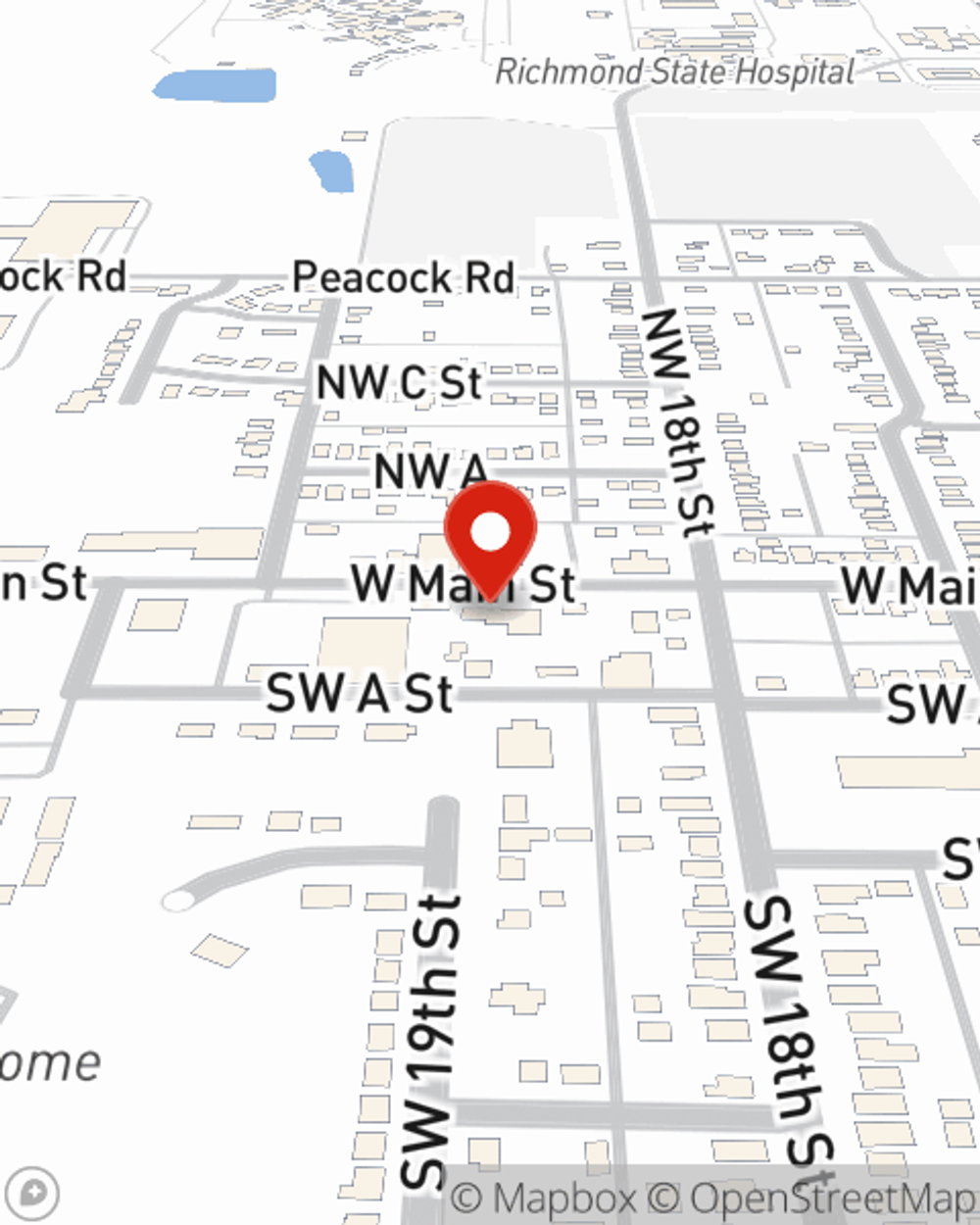

Business Insurance in and around Richmond

Richmond! Look no further for small business insurance.

Helping insure small businesses since 1935

- Richmond, IN

- Centerville, IN

- Cambridge City, IN

- Fountain City, IN

- Hagerstown, IN

- Greensfork, IN

- New Paris, OH

- Lynn, IN

This Coverage Is Worth It.

Do you own a pet groomer, a bakery or an art school? You're in the right place! Finding the right coverage for you shouldn't be risky business so you can focus on your next steps.

Richmond! Look no further for small business insurance.

Helping insure small businesses since 1935

Strictly Business With State Farm

Each business is unique and faces a different set of challenges. Whether you are growing a fabric store or a window treatment store, State Farm provides a large range of small business insurance options to help your business thrive. Depending on your product, you may need more than just business property insurance. State Farm Agent Mike Miller can help with extra liability coverage as well as commercial auto insurance.

Since 1935, State Farm has helped small businesses manage risk. Reach out to agent Mike Miller's team to discuss the options specifically available to you!

Simple Insights®

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.

Mike Miller

State Farm® Insurance AgentSimple Insights®

Before you rent, ask your landlord about move-costs and monthly bills due

Before you rent, ask your landlord about move-costs and monthly bills due

Rent, deposits and fees can sometimes get tricky if they haven't been discussed thoroughly with your landlord before signing a rental agreement.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.